Think2 Funding

Some families may be eligible for a funded 2 year old place if they meet certain criteria – please click on this link for more information:

At Tom Thumb we offer

- Up to 12 hours per week for the full 47 weeks that we are open.

Funded hours are taken between:

- 8am – 4pm – 8 hours

- 9am -4pm – 7 hours

- 8am – 1pm- 5 hours

Hours outside these times are charged at normal nursery rates.

…

Funding

Children may be eligible for funded hours the term after they turn 9 months old.

At Tom Thumb we open throughout the year over 47 weeks so our offer equates to:

- Up to 12 hours per week for

- Up to 24 hours per week

Funded hours are taken between:

- 8am – 4pm – 8 hours

- 9am -4pm – 7 hours

- 8am -1pm – 5 hours

Hours outside these times are charged at normal nursery rates.

At Tom Thumb, we are committed to providing high-quality care while remaining compliant with the Department for Education’s (DfE) statutory guidance. Our recent Outstanding OFSTED reports on our high level of care and attainment and states all children flourish in this highly professional and nurturing environment. Children develop a thirst for learning and consequently make rapid progress from their starting points.

What the Local Authority Funding Covers

The hourly funding rate we receive from Staffordshire County Council covers “delivery and learning” only. This includes the staffing, planning, assessment and delivery of the Early Years curriculum during your child’s funded hours.

What the Funding Does Not Cover

The funding does not include the wider costs involved in providing a high‑quality nursery environment. These additional costs remain the responsibility of the provider and require contributions from families.

Examples of non‑funded items include:

- Nutritious Meals, carefully crafted menus and healthy snacks

- Hygiene products (wipes, nappies, nappy sacks, gloves, bibs, flannels, bedding, daily laundry, creams where applicable)

- Enhanced resources including higher staff ratios. Visits from special visitors to enrich the children’s learning experience. This may be professionals who offer workshops or themed cultural sessions. While these visits add significant value to our curriculum, they are not covered by the local authority funding rate.

- Printed photo journals

- Craft Consumables and Additional Learning Materials. Local authority funding does not cover the wide range of craft consumables and learning materials we use every day to support high‑quality early education. These items are essential for delivering a rich, hands‑on curriculum, but they are purchased directly by the nursery. This includes materials such as:

- Paint, glue, glitter, clay and modelling dough

- Paper, card, envelopes and printing supplies

- Natural and sensory resources used for exploration

- Loose parts for construction and imaginative play

- Seasonal and themed craft items

- Replacement materials that are regularly used up or worn out through play

These resources allow children to explore, create, experiment and express themselves — but because they are consumable and need frequent replenishment, they fall outside what the funding rate is designed to cover. Contributions help us maintain the high standard of provision that families expect and children deserve.

- Administration of digital platforms, including Facebook updates and online communication systems

- Enrichment activities such as weekly cooking sessions, Welly Wednesdays, Movement Mondays, Antlers café visits, High Ash trips to see the animals, party days, Christmas trees festival and lots of other community experiences

Why We Ask for Contributions

These extras are not covered by the local authority, but they significantly enhance your child’s experience. Contributions help us maintain a rich, engaging and well‑resourced environment that supports children’s learning, independence and enjoyment.

To sustain the quality of our provision, we apply a daily consumable charge to funded sessions only of £11.00, which is broken down as follows:

- Food & Drink (£7.50): Includes a cooked breakfast, a nutritious 2 course lunch, and two healthy snacks daily including a variety of fruits, berries, vegetables or a more substantial carbohydrate based snack in the colder months

- Non-Food Consumables (£3.50): Includes wipes, nappy cream, nappy sacks, sun cream, first aid supplies (including Calpol / Nurofen for emergency use), and specialized learning resources to support the enhanced curriculum. This also includes a higher staff ratio ensuring children get the best quality care and attention they need.

How the Tax‑Free Childcare Scheme Reduces the Consumables Charge

Our consumables charge is £11 per day on funded sessions only. However, many families are eligible for the Government’s Tax‑Free Childcare scheme, which contributes 20% towards childcare-related costs.

When families use Tax‑Free Childcare to pay for their consumables, the Government covers £2.20 of the daily charge. This means the amount families pay is reduced to:

£8.80 per day instead of £11.00

Tax‑Free Childcare can be used for consumables, additional hours, and other nursery charges, making it another helpful way to reduce weekly costs for eligible families.

Eligibility

Your eligibility depends on:

- if you are working

- your income (and your partner’s income, if you have one)

- your child’s age and circumstances

- your immigration status

You can get 30 hours free childcare at the same time as claiming Universal Credit, tax credits, childcare vouchers or Tax-Free Childcare.

If you are working

You can usually get 30 hours free childcare if you (and your partner, if you have one) are:

- in work

- on sick leave or annual leave

- on shared parental, maternity, paternity or adoption leave

If you’re on adoption leave for a child aged 3 to 4 years old, you must return to work within 31 days of the date you first apply for 30 hours free childcare for that child.

Your income

You’ll need to expect to earn a certain amount over the next 3 months. This is at least the National Minimum Wage or Living Wage for 16 hours a week on average.

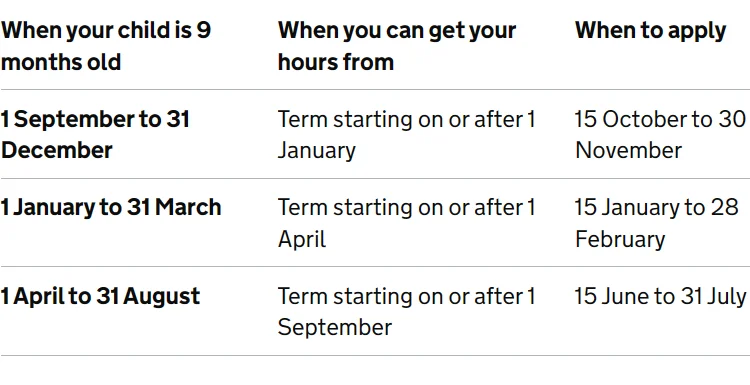

When to Apply for 30 Hours Funded Childcare

To help families plan ahead, here’s a guide to when you should apply for 30 Hours funded childcare based on your child’s date of birth:

Important: You must apply before the deadline to receive funding for the following term. Applications can take time to process, so we recommend applying early within the suggested window.

Apply for 30 hours free childcare

Tax Free Childcare

What is the scheme?

Tax-Free Childcare is a scheme which gives eligible families up to £2,000 free per child towards childcare costs.

You may be able to open a new online childcare account via www.childcarechoices.gov.uk which for every £8 you pay into, the government will pay in an extra £2 (up to £2,000), so it effectively gives you basic-rate tax back on what you pay, hence the scheme’s name.

Am I entitled?

To qualify, parents must be working. Tax-free childcare can’t be used at the same time as childcare vouchers, Universal Credit or tax credits. However, 30 hours free childcare can be received alongside this.

You’re usually eligible if your child is under 12 (17 if disabled) and all of the following apply to you (and/or partner):

- are 16 or over

- are over 21 and earn on average at least £152 a week, unless in your first year of self-employment

- earn less than £100,000 a year each

- don’t get other support with your childcare, including from a childcare voucher or salary sacrifice scheme

How to apply

You can apply for tax-free childcare at Tax-Free Childcare – Best Start in Life You will need to provide your email address and your child’s date of birth.

…